In this first part of a two-part series, we explore significant proposed changes to EOS Tokenomics. Each installment will cover different aspects of the new economic model, providing insights to help the community understand and prepare for these updates.

Part I: Unlocking New Economic Potential

The EOS System Contracts v3.4.0 release marks a watershed moment for the EOS blockchain, introducing foundational changes to its tokenomics. These proposed updates, designed to accommodate the needs of the previously released New EOS Tokenomics Proposal, aim to stabilize and predictably grow the EOS token economy by implementing a fixed supply model.

The first round of changes detailed here will take effect only after successful approval of a multi-signature (MSIG) by at least 15 of the 21 EOS block producers (BPs).

View the MSIG here:

- EOS MSIG Viewer – https://msigviewer.netlify.app/mainnet/larosenonaka/tokenomics

- Bloks.io – https://bloks.io/msig/larosenonaka/tokenomics

Key proposed changes include:

- Transition to a fixed token supply: Capping the total EOS tokens at 2.1 billion.

- Token vesting schedules: Introducing vesting schedules for network custodians such as EOS Block Producers, Staking Rewards, the EOS Network Foundation (ENF), and EOS Labs.

- Immediately liquid tokens: Allocating funds for the purchase of 35 million EOS in RAM and 315 million EOS for RAM market making.

These tokenomic updates also set the stage for subsequent enhancements to REX, including EOS staking rewards, and a more flexible distribution of system fees.

Upcoming in Part II: Exploring the Transition to REX 2.0

In Part II of our series on EOS Tokenomics, we will delve into the proposed transition to REX 2.0, which will initiate high yield staking rewards for EOS token holders for locking their stake.

EOS staking rewards are expected to begin by the end of June with the implementation of REX 2.0. This transition to REX 2.0 is dependent on the successful implementation of the changes introduced in the first MSIG for the System Contracts v3.4.0, as outlined in this article. The forthcoming changes aim to enhance the Resource Exchange (REX) by:

- Diverting system fees to Block Producers (BPs)

- Enabling the drip from staking rewards into REX

- Changing the REX staking lockup period from 4 days to 21 days

These changes aim to enhance the functionality and flexibility of REX, providing more robust and predictable returns for participants.

Stay tuned for Part II, where these aspects will be explored in detail, promising further improvements to the EOS network’s robustness and functionality.

Unlocking Economic Potential

The EOS System Contracts v3.4.0 upgrade introduces necessary changes to support a major change to EOS tokenomics, bringing an end to EOS inflation and changing how token distribution functions.

Immediate Token Liquidity Upon MSIG Passage

Upon successful passage of this MSIG, these tokens will be liquid immediately:

- 315 million EOS will be allocated for market making and liquidity provisioning across both centralized exchanges and DeFi across multiple blockchains.

- 35 million EOS will be used to purchase RAM from the system Bancor pool shortly after the passage of the MSIG. The RAM purchased through this mechanism will be used for support or funding of EOS ecosystem initiatives.

- 15 million EOS will be dedicated to public goods funding for middleware development to improve the usability of the EOS Network.

Strategic 35 Million EOS RAM Purchase

One notable aspect of the new tokenomics model is the strategic management of EOS RAM. If the proposed MSIG is approved by 15/21 of active EOS BPs, 35 million EOS will be used to purchase RAM from the system Bancor pool.

The RAM allocations will be acquired through multiple transactions of varying amounts between the new tokenomics being approved and the Spring 1.0 hard fork.

The RAM purchased through this mechanism will be used for support or funding of EOS ecosystem initiatives. In parallel to this initiative, RAM will also be acquired by professional market makers to establish WRAM (wrapped RAM) liquidity on a variety of centralized exchanges (CEXs) and decentralized exchanges (DEXs) to increase market depth and accessibility for EOS RAM.

EOS RAM Resources:

Defibox

Newdex

RAM Price Calculator

EOS Eyes

RAM Utilities

Key Changes to EOS Tokenomics and Detailed Implementation Steps

The upcoming EOS System Contracts v3.4.0 upgrade will introduce significant changes through a carefully planned series of steps, pending the approval of a key multi-signature (MSIG) proposal. This approach ensures a smooth and well-regulated shift towards the new tokenomics model. Below is an outline of the primary changes and the methodical steps to implement them, arranged to reflect their planned order of execution once the MSIG is approved.

For more comprehensive details and insights into the EOS System Contracts v3.4.0 upgrade and the upcoming tokenomics changes, you can visit the EOS Tokenomics (System Contract v3.4.0 Upgrade) README on GitHub. This resource provides in-depth information and technical specifics on the changes and how they will be implemented.

- Creation of New Accounts/Buckets:

- New accounts and associated contracts are being created to manage the distribution and allocation of tokens, ensuring structured economic management:

- eosio.reward: Handles system reward distribution.

- Permissions: (15/21) ( eosio )

- eosio.fees: Manages the acceptance and distribution of system fees.

- Permissions: (15/21) ( eosio )

- fund.wram: Used for RAM market making and liquidity provisioning.

- Permissions: (2/2) ( eosio.grants + eoslabs.io )

- eosio.mware: Dedicated to public goods funding for middleware development.

- Permissions: (2/2) ( eosio.grants + eoslabs.io )

- eosio.reward: Handles system reward distribution.

- New accounts and associated contracts are being created to manage the distribution and allocation of tokens, ensuring structured economic management:

- Deployment of New System Contracts:

- The eosio.system and eosio.token contracts are updated to enable the new tokenomics features. The update to the eosio.token contract includes new actions for managing the token supply, such as setting the maximum supply (setmaxsupply) and issuing the remaining tokens up to this limit (issuefixed). These updates are critical for facilitating the transition to a fixed supply model and ensuring that token distribution aligns with the new economic framework.

- Set MSIG Execution Time:

- The MSIG is timed to ensure all actions are synchronized and executed in a controlled manner. The MSIG is scheduled to be executed no earlier than June 1, 2024.

- Retire Unvested b1 Tokens:

- The ~64 million EOS tokens, previously allocated for vesting to the b1 account from the eosio.stake system account will be reclaimed and retired. This action clears these system reserves, aligning with the new fixed supply model to optimize the economic structure.

- Set Maximum Supply and Issue Fixed Supply:

- The maximum supply of EOS tokens is set at 2.1 billion.

- The system issues the remaining tokens up to this cap, expected to be around 974.6 million EOS, to reach the new total supply limit.

- Transfer EOS to Distribution Accounts:

- Transfers are made from the eosio system account to the newly created fund.wram and eosio.mware accounts to allocate funds for specific purposes:

- 350 million EOS to fund.wram for RAM ecosystem enhancements.

- 15 million EOS to eosio.mware for middleware development.

- Transfers are made from the eosio system account to the newly created fund.wram and eosio.mware accounts to allocate funds for specific purposes:

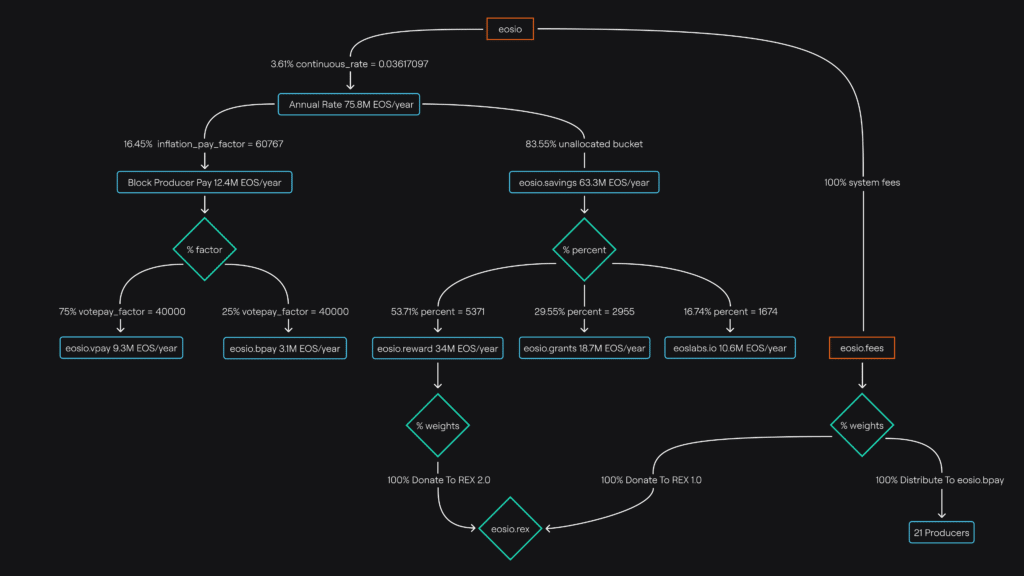

- Adjust Inflation Pay Factor and Set Pay Factors:

- Pay Factor Allocation: The annual rate pay factor is distributed with 16.46% going to block producers (bpay & vpay) and 83.54% allocated to eosio.saving which will flow to ENF, Labs, and Staking rewards.

- Set and Execute Vesting Schedules:

- Annual Pay Rate: Initially set at 3.617%, which translates to distributing approximately 76 million EOS per year.

- Halving Schedule: A 20-year halving schedule will be implemented, starting with a 4-year cycle and halving every four years, culminating in a distribution rate of 0.01%. This approach moderates the influx of tokens into the market, ensuring a controlled release.

- System Fees Upgrade and Configuration:

- Deploy the eosio.fees contract to manage and distribute system fees to new buckets, such as block producers and REX.

- Set Savings Distribution Ratios:

- Distribution to eosio.saving: The tokens channeled to eosio.saving are further distributed among key network custodians and initiatives: 53.71% to Staking rewards, 29.55% to the EOS Network Foundation (ENF), and 16.74% to EOS Labs.

These steps are designed to provide a clear and structured approach to implementing the new EOS tokenomics efficiently and transparently, contingent upon approval by at least 15 of the 21 EOS block producers. This methodical implementation is essential for the robustness and reliability of the new tokenomics framework.

Testing and Approval

- BlockSec security audit completed: No critical issues found, all recommendations resolved in RC2 releases.

- Deployed on Kylin & Jungle4: Tested all new system actions & tokenomics mechanics.

Community members and block producers are encouraged to interact with these new system functions to ensure smooth integration. The final implementation will occur after successful approval of the MSIG by at least 15 of the 21 EOS block producers. This thorough testing and approval process is critical to ensure the reliability of the new tokenomics framework.

For a detailed breakdown and technical specifics of the upcoming MSIG, please refer to the EOS Tokenomics document on GitHub.

Acknowledging Contributors

Special thanks are extended to the contributors who played crucial roles in this release:

Their collaborative efforts have significantly shaped the features and robustness of the updates in this release, underscoring the community-driven approach of the EOS blockchain development.

What’s Next? Gearing Up for Part II: Transforming REX Dynamics

As we look ahead, anticipate further in-depth exploration in Part II of our series, “Transforming REX Dynamics.” We will delve into the proposed transition to REX 2.0, set to bring about crucial enhancements like redirecting system fees to Block Producers, incorporating staking rewards into REX, and extending the staking lockup period to 21 days. This next installment will build on the foundational changes discussed here, focusing on optimizing and enhancing the functionality and flexibility of REX within the EOS ecosystem. Stay tuned for more insights!

EOS Network

The EOS Network is a 3rd generation blockchain platform powered by the EOS VM, a low-latency, highly performant, and extensible WebAssembly engine for deterministic execution of near feeless transactions; purpose-built for enabling optimal Web3 user and developer experiences. EOS is the flagship blockchain and financial center of the Antelope framework, serving as the driving force behind multi-chain collaboration and public goods funding for tools and infrastructure through the EOS Network Foundation (ENF).

EOS EVM

The EOS EVM is an emulation of the Ethereum EVM, housed within an EOS smart contract. It offers feature parity to other EVMs in the space but with unmatched speed, performance and compatibility. EOS EVM connects the EOS ecosystem to the Ethereum ecosystem by allowing developers to deploy a wide array of Solidity-based digital assets and innovative dApps on EOS. Developers can use EOS EVM to take advantage of Ethereum’s battle-tested open source code, tooling, libraries and SDKs, while leveraging the superior performance of EOS.

EOS Network Foundation

The EOS Network Foundation (ENF) was forged through a vision for a prosperous and decentralized future. Through our key stakeholder engagement, community programs, ecosystem funding, and support of an open technology ecosystem, the ENF is transforming Web3. Founded in 2021, the ENF is the hub for EOS Network, a leading open source platform with a suite of stable frameworks, tools, and libraries for blockchain deployments. Together, we are bringing innovations that our community builds and are committed to a stronger future for all.